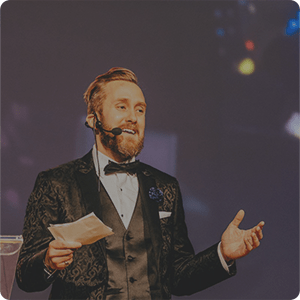

Jan Christopher

Founding Managing Partner @ Holt Accelerator

Charting the course and learning – Jan Christopher

“Whether they’re even asking for it or not, I think that is an important piece to always remember where you came from. I think that’s important to building a community to remember those and give recognition to those who have supported you along the way.”

ABOUT

Jan is a fintech evangelist, passionate about improving society through finance and technology. He is Managing Partner & cofounder of Holt Accelerator that has currently invested in 20 early stage Canadian and International fintechs, in which those portfolio companies solve our society’s most pressing and emergent issues. Previously, he founded Fintech Cadence, a non-profit that has trained thousands of individuals in fintech, resulting in the creation of +100 fintech projects.

Prior to this, he was Head of Finance at Bus.com, helping it from incorporation to Series A, as well as Head of Finance at District 3, helping 20 early stage teams raise more than $15 million. He began his career as a Consultant for billion dollar investment banking projects in the space satellite sector. He holds an MBA from HEC, a finance degree from Ottawa University, passed II levels of the CFA, and was awarded Montreal Ambassador of the year (2018) from the Montreal Startup Awards.

THE FULL INTERVIEW

Jan Christopher

The full #OPNAskAnAngel talk

Jan: It’s great to be here. Thanks so much for having me.

Jeffery: Well, we’re excited to talk to you because one of the biggest reasons that I think I was really diving into learning more about yourself was that you focus strictly on Fintech. And that is huge because there’s not a lot of investors that have really funneled themselves into one area of focus and then been really good at it. So, I think we’re going to start today off if you can share a little bit about yourself, some background, all the way back to your university days, even from bus.com. But share a little bit about that. And then one thing about you that nobody would know.

Jan: oh, we’re digging pretty far back there. So, I’ll try to keep this relatively quick so as not to make people fall asleep here. But I was always in finance. That was what I chose in university from the early days. So, me being in Fintech maybe is me just trying to justify my own existence or my degree that I had recently received. well recently is a bit of a stretch I would say. But since then, I became a consultant and I was doing M&A transactions in the satellite sector, billion dollars, plus always looking to automate things. I eventually said, how do I get more into this? I want to get really working hands-on with startups. What skills do I have? I started being the finance guy, helped about 15 companies, raised 20 million bucks, including bus.com which was sure. the bus, when I had joined them, and then the team and Kyle and Wolf when we were not even incorporated at the time, and working next to a space heater and an art studio trying to figure out how to make ends meet and helping them raise capital. At that point, I did that for a bit until they got to about series a. I left off at that point to start to explore what could be done. I recognized that the early stage ecosystem and Fintech was missing within Canada. We weren’t having the right conversations. the thought leadership was missing. that buzz that you get when you go to the valley that everyone’s just oozing with ideas and startups as a whole just felt like it was disparate and diverse groups unconnected across Canada that I said, how do I solve this. And so, I built this thing called, ‘Fintech Cadence’, the nonprofit that’s doing well to this day. it’s nurturing that next generation of talent and early ideas and projects and yeah, early startup shall we say. As they recognize, a good ecosystem requires a funnel and the next bit of that funnel was helping those venture businesses right at the growth stage that I still think is missing which makes for a wicked opportunity bumped into a fifth-generation family who also knew wealth management for hundreds of years. They said they want to do Fintech, that’s what they know based on the legacy of Sir Herbert Holt who was the largest serving chairman of the Royal Bank of Canada, and took it to grow its assets about 10x. So, they do know a little bit about how to build the financial services within Canada. internationally partnered up with them, we got started and we’re off to the races like that. So, it’s been a fun ride. I mean something about myself I guess is I’m always trying to give a hand back to those early sponsors. those early supporters that have helped me along the way and find a way no matter what the mechanism to reward them on the upside and remember them along the way. whether they’re even asking for it or not, I think that is an important piece to always remember where you came from. I think that’s important to building a community to remember those and give recognition to those who have supported you along the way.

Jeffery: I love it. That’s all brilliant. And a big fan of helping people and giving back. I think that is the smart way to do business. But I think it’s also when you’ve learned a lot, it’s really helpful to be able to figure out how you share that back and how you help that new generation of founders come through. And I want to take that piece and take a step back to even your bus.com days when you were working in this and you said you were working in this heater cold environment that you were trying to build from and it was really right down from the nuts and bolts of really what it takes to run a startup and be part of that. you have this hat that you’re wearing that’s all Fintech based which I think is phenomenal. I find that a lot of people in the banking sector tend to have a lot more knowledge of how to run a company and be part of a company than any other group. lawyers probably stepped in there as well because they get to do the paperwork side. But I just find that people that understand Fintech understand the numbers. They can really put together how this business looks today but also how it’s going to scale and can this be a business in five to ten years. So, in saying that, when you joined the bus.com, what experience did you take from that and how much of that you see coming out today in what you’re building?

Jan: I think the idea of looking at the top companies when it’s the c-suite level, there’s a big portion of the time they’re going to have a finance background, the understanding, the lifeblood of the mechanism of the organization to identify the areas to focus your time on and the problems and opportunities. It’s not always the case either. There could be schools of thought opposed to this in the sense that there is something called ‘shareholder value versus stakeholder value.’ and some will look to maximize shareholder over stakeholder and there’s the school. There’s debate on which one is better for the long-term benefits of all. But I’ll digress from that point, leave that as a bit of a cliffhanger and get back to say, when you’re in the finance position and increasingly, I’m seeing this more with those that were in the venture capital space as well, there’s like this, oh everyone wants to get into venture capital. But really what you’re doing is you’re acting like an operator in many ways for your portfolio company. So, in many ways that I was, I had multiple companies working with, and bus.com was the main one that I was spending a lot of time with as the finance person helping them raise the capital like that investment banker style but also trying to identify new opportunities for them to support. And so, we looked at things for instance like RND projects. I was big on multi-disciplinary teams and partnering with academic institutions and bringing in the top talent, the top students. because we all know getting talent is incredibly hard. If he goes directly to professors, they’re usually going to refer their top students to be able to work on this project. And they’re good like we do have good students here in Canada. And then when you do that, it’s actually pretty easy to get grant money. We love to give money towards anything that’s deep R&D. And it’s pretty easy to spin it when you’ve got professors and students now working and they’re excited about it because you are building good stuff. And so, that actually built a lot of the basis for the moat underneath bus.com. And because there’s a lot of optimization models that they needed as they built that out and spoke to a larger vision that was there and continued to invest in after, I was gone. I’ve been a little removed. It’s been a couple years. I’m only assuming as such now. But I think those were fundamental. like we’ve been recognizing how important it is to build your tech stack and your moats but leveraging what we have in Canada is the ability to build deep END to complement what you’re building. It’s pretty. It’s very rare. I don’t see a place where you can’t apply technology and deep RND to be able to solve what you’re doing. And especially, seeing that across the case for all the Fintech that we’ve been. But like it isn’t. I mean when you’re in the finance position there, you tend to jump from different departments. you’re building financial models from the marketing side and saying okay, well, where is the most cost-efficient way from the marketing tactics that we’re using. What about the sales team? And how do we better incentivize them? I’m big on finding the right incentive mechanisms to be able to make it work. So, you end up getting a breadth of a lot of different areas from it. And then through that, you recognize what needs to get built to be able to get to your fundraising’s next milestone. So, now, when you go into it, we somehow ended up with this fund and we’re investing in companies. well we have just this natural reaction where they need to focus that will maximize the odds of them being able to close their next financing round.

Jeffery: That’s great. And what I really liked about a few of those things that you said, and even you started by going into the shareholder versus the stakeholder. And I can remember back from my corporate days, one of those things was that you’re in a big organization and when you’re running and gunning and you’re growing quickly, usually you have a product person that’s running the business because they’re all about sales, closing deals aggressively, growing this business. And then when things are about to retract, and you need to find a way to cut costs, re-engineer the business, the model you put in a finance person. So, now that finance side goes in and restructures everything and figures out how to trim things down, so now you go back to the best for the business at this time. And I find that a lot of the startups tend to push away the finance side at the beginning because they don’t typically understand the numbers or understand the metrics. And it sounds like what you were doing at bus.com is you were really becoming that revenue officer. And you were figuring out all the different avenues on where you can save money, make money and grow the business and scale it. as you said to that, series a component while you were using RND dollars. And you were getting government subsidies bursaries, whatever that might have been, figuring out how to make this business grow and be stable which I think is really crucial. And a lot of investors, angel investors, early stage, really do lean on that. And I wonder if there is a lack of understanding and finance at such an early spot, how do these startups get a better position or find somebody like yourself to really help them work their way through these great questions?

Jan: I did want to double back just quickly on the idea of shareholder versus stakeholder value. while I’m certainly very well attuned to shareholder value and financial modeling. And Looking at it, you’ll be surprised by how many ways you can quantify things to ensure that you can better pinpoint it. There are times where it’s harder. And it’s a bit of a feeling. you do your best to get your analytics and your numbers in place and that is the key to the good founders. When I was watching and working with Kyle during his days, he was very fortunate. He truly understands that. And there’s a creative aspect to it as much as possible. So, you have to trust the instincts of those driving the bus in this case, which leads to new areas that have substantially longer term value. So, you think, well should we be cutting all these costs here to optimize shareholder value in the short term? we might be foregoing a long-term benefit of building a better community of stakeholders who actually in turn generate value. we’re not able to quantify yet. maybe just because we haven’t asked the right questions. We haven’t cut it the right way to look at it. And in doing so, we might be foregoing that opportunity, that once we do figure it out, and when it hits a certain level, you go, wow, this is super value-added. We didn’t quite see that right away. And that’s a bit of the instinct that you try to find in good founders. And it’s hard sometimes when you’re having conversations with people who only see it from an M&A shareholder perspective. You can have a lot of friction and there is a lot there, depending on where you’re from. Sometimes there’s a geographical perspective of arguments on this that some might be better trained in shareholder value versus stakeholder. But it’s a balance between both and hopefully I’m no reason. The message to get out here is if you are in one camp, try to start seeing the other side because that is the line that you need to really be able to walk for us to have better conversations on how to start building these businesses better. to your point on where startups can find this, as they go forward, I mean there’s never been a better time right now to be a better startup. It doesn’t mean it’s not hard. There are plenty of programs. like I personally got started and then now, the team has taken off on their own rights and very successfully Fintech cadence to support those early founders and get into the next milestones. There’re tons of people now that are playing those sorts of financial roles to support. And in the early grinding, I did that before. I helped 15 companies raise 20 million bucks. you try to get creative on the ways that you can be paid because they don’t always have a lot of capital upfront. I do believe in success in space. And if you are good and you can put your name on it, and you did the research on that company, then you should be more success based. And it can be actually more profitable for you to be able to do it that way. And so, yeah, I think between all the things that are readily available, it’s hard. though it’s very time consuming and that’s a bit of the challenge in the ecosystem. It is that a lot of these, let’s call it grants or early funding tickets, take a lot of work. when you’re getting those first angel checks or the friends and family, if you can rely on that, or if you’re pulling from these grants unfortunately sometimes take a really long time to fill in. And we’re still not quite there. So, that’s more of a message to those higher up, to further improve and rubber stamp them. I think they serve a good cause. I think we need more people focused on the early stage funnel because I think sometimes, we overlook how we are going to continue to build this. And I do think they are working. They are slightly inefficient and there are different people who think we should do different things with these types of mechanisms. Whether I don’t believe, the answer is completely removing them as I’ve seen a lot of companies use them just to springboard themselves into the next stage of their company. But yeah, there’s tons available. it just takes a decent amount of time to review. So, it sounds like you are going to really find somebody that has some experience in early stage modeling. And at least understand how and where to start to help that found road. And if we look at it and say that a founder typically seems to be an operator or a product person, the odd time they’re going to veer outside of that, they could be a technical founder. they could be more on the numbers side. But I find that that seems to be less than it is. more so, you really are looking for someone that understands this. And when do you see this as being crucial to the business? Do you see this after they raise their first funds? they should be looking for a part-time CFO. or they wait till they get to a series a? like is there a timing where, because it’s the same thing when you find a co-founder that’s technical because you didn’t do that right from day one. or do you wait until you build your product to go to market then find a CTO? or do you wait until you’ve got some dollars in there? So where do you see that being a good win for a founder and not being cost depreciating against the business? because obviously every founder can’t afford to have a CTO, a CFO, and a CMO all in one day. when they’re in their c round, yeah of course.

Jan: A fantastic question. So, it just depends on the stage game more often than not. My perspective was based on the budgets. it depends like, okay, if you have resources and you’re fortunate enough, you should already be having a CFO for a day, a week type of thing. not everyone’s in that boat because they didn’t have sufficient capital to do it. they’re incredibly bootstrapped. So, what a lot of the early stage founders we used to work with. It was almost part of the game, to train them. So, if you would go to different incubators and what not, like that’s what my role was essentially. I wouldn’t necessarily do all the models. I would get them the templates. I’d have them fill it in and have them walk it. So, they understood what they were doing because that’s going to be an important piece they’re going to need to at least understand what is being communicated to them. So, that way, when the CFO comes in eventually through time, they can have better conversations and direct them and delegate to them as they truly have a better understanding. But that’s a bit of a line you have to walk between you. Are they able to learn? can they get the expertise in-house to be able to build it? and at some point, there’s just too much modeling that really needs to get done. generally that comes. I mean you would love to see it at the seed but definitely the series a, you need to have a bunch of models properly articulating the unit economics of where you’re going. it’s where you get the seed. That’s where we’re pushing our teams to already start to model at that stage and just show that they’re thinking about it. show the assumptions behind it and you can get part-time people to come in for a day a week, quite affordable to get those analytics and help curate those numbers accordingly. or you need to find out how to do it yourself like you got to have your financial projections and model in order. I mean that’s the bare minimum to get started. It’s easier when you already have the background to do it because you can whip it together relatively quickly. If not , the issue of course is it takes time if you’ve never done it before. it’s probably going to take you like a week but then you have to ask yourself is it better suited as a founder to go off and close business and spend a week on a financial model? Someone who’s good at it can do it in half a day, like it’s just about trying to balance thinking about how much time is money, the resources and where you’re better suited to focus and prioritize.

Jeffery: oh, that’s great. And you’re right that there’s going to be a benchmark of where this is going to be more successful for you to bring somebody in where you can financially support it. But investors are also looking for that stability as well. they’re looking for someone that is in that role versus having it all done by the CEO. The CEO can only do so many things to make a business effective and efficient. So, you’re right. I do see that as being pretty crucial. It’s interesting. I remember when I started my first company. I had three days to put a financial model together and I literally had a friend. And I’m like look, I don’t even have time to do this. I’m not pitching doing this. Can you put this together for me? It took them five days. By the time I got it back, I was almost in the realization of doing this myself. And it’s funny because when you do it yourself, you learn quickly what you need, what you don’t need. And then after that, I started just obviously learning and building them myself. But once you start to move through the business, you also start to look for those efficiencies and find people that are rock stars that can circumvent that time. And now you’ve got someone that can do a model in half a day. they understand your business. they understand what you’re trying to achieve and now investors can get behind that as well. They can put in their two cents and you can keep modeling and changing because really at the end of the day, investors are looking for companies that can scale quickly and be totally investable. And This financial peace is pretty crucial to any of that movement.

Jan: great. when you’re looking at the scaling aspect or where you guys have now, start to step in yourselves and start looking at these pre-seed or seed brown companies in the Fintech space. How crucial is it for you to have people on the team that understand finance? or because they’re early on, you guys can overstep and take that position for those startups to help them. It’s one aspect right. Like he’s looking at building a startup, you are going to be skilled across multiple disciplines to be able to make it work right, or be able to find people to support you in that. But as the founders, you still need to understand it. So, you can’t just offload it and not expect and then say, tell me what the numbers are, like you need to understand the meeting. But from our side generally, I mean as much right around, the seed they’re growing we’re starting to build their unit economics of it. Here’s an opportunity. like what’s the customer acquisition cost, like the true one in terms of how you’re going and the leads. And how they’re moving through the funnel and the time and the cycles and all that stuff moving into how much money are you making. And when do the checks come in? and when is the first close to it? and what could be the expected lifetime value of it, which is even more hypothetical at that point because it’s relatively still early right. you just want to see that they’re able to repay the customer acquisition cost quickly right as fast as possible like a month or what not. So, when do we start? I mean yeah, we work with them. We start helping them model it so we work directly with founders to be able to do it. And then we have partners speed up that we can send to them to say, hey, do you want someone to do it with you? you’re tight on time. Usually they’re starting to raise rounds with us so capital is available. We think it’s pretty important to be seeing a difference between those who do it to raise the money and those who do it because they’re learning right. They understand the importance of charting the course by leveraging these accordingly which is an interesting perspective. So, yeah, I would say at that point, it’s about a day a week of time. I would say usually. And then as you go into the a, you start asking yourselves even after a proper seed, do you start bringing in someone full time? but they’re going to have a bigger role beyond that. that is your operations person who can also branch off into it. can they wear multiple hats beyond just the finance role? you find the talent that you’re bringing in at any of these stages. And I think this would be good for a startup to understand. It is that I think when people start to build companies, they think everybody that comes in needs to be working for them today. we’ll be working with them in five years. And what have you seen in the last few years of startups? How fast are they transitioning and growing their business, scaling? and then how fast are people transitioning in and out of their business? Is there like a two to three-year window? does it know what the same team that I would start working with in their pc? they’re still together at their Series B and they’re crushing it like what you are seeing in that avenue. And What can founders look forward to and what things should they be looking for when they are hiring this talent? Yeah, it’s a great question. especially right now with the great quitting that’s occurring. opportunities are plentiful. I do think that from our portfolio companies, for the most part, they’ve done a great job of being able to maintain the staff that are in there on average usually.

Jeffery: you mean, it’s all about balancing the vision and what you’re building and the opportunity that they’re getting because you could go work for potentially corporate, have substantially more stability. But at the cost of stability, you might be bored because you have your focus and your departments. you don’t feel like you’re contributing the same way when you look at the specter of what it takes for a person to be satisfied with their work.

Jan: I think there’s multiple avenues. compensation is one and you can compensate yes on salary and you can also compensate on upside potential through shares. Okay, so is there a greater upside there? That climate is making it interesting for them to participate. And inside a little note for these early stage startups, everyone should really look into health care plans because generally it’s actually very economical because you’re already paying some into the healthcare system automatically through the taxation issues. So, you’re better off actually looking at it because it’s a slightly marginal increase for what I think is a great value, add to little park WM to be able to offer to your employees. When you’re at that stage, you have to have at least three employees. So, knowing what your stage is, but from the employee, so beyond that though the other side is like, how do you build your brand right now? What is a brand? it’s your own personal brand. like are you growing your skill sets in that sense? But are you meeting people? Are you familiar? Are you recognized as a leader there? have you been networking and associated through that position so that you have more, let’s say power and distribution and network to lean on as you go forward. The other thing that’s not as well understood is the idea of learning right, to be able and I think sometimes we forget that we pay to go to school. And then we get a job and then we just start saying hey, I want to get paid the most at the cost of learning which is unfortunate in many ways because that should be the way to for self-fulfillment. It’s a path to be able to identify how to grow and jump the ladder or the corporate ladder. Because if you’re deep in an area that requires expertise, and you’re passionate and you’re loving what you’re learning, it is key. And the last is just a great work environment right. like obviously, does it align with your personality and your beliefs? so those are all different spectrums and so each person you have to identify when you’re speaking to them. Do they really want to be in a startup? Are they testing this out? have they been in it before? do they know what to expect increasingly? you are seeing more people that are jumping from coming in and working for x amount of years and getting some equity and building a portfolio of equity and going on to the next thing. But if you’re able to line up those sorts of four points that align with your company and that person which is hard to do, I mean it’s still either you’re going to have something. Sometimes it still feels a bit like a coin toss right. When you’re hiring for people, especially at this time, you can see good retention. We’ve seen some of our companies be able to maintain their staff for five years and they’re like five years old. So, how have they done that right? Because they’ve grown at the right pace to show that it’s starting to yield rewards. that the lines with this vision they’re bought into, they’re contributing to a bigger mission here. they feel they’re instrumental in that journey, learning a bunch, building their network. So, they’re hitting all the aspects right. But in other cases, if you’re not growing as fast right, and then you’re asking about the compensation, okay, I’m learning. But at what cost can I learn just as much? else we’re making more money. then you start asking that and startups can be tiring right. they can be at some point. you want to coast. And believe it or not, you want to coast by going back to corporate law. It paid well to work nine to five jobs.

Jeffery: Oh that’s great. And I want to touch on one of those pieces like I think the way you broke that down. I love the breakdown on the things you look for in a role. But this is also from an employer or the CEO of the company trying to keep people employed. They want to make sure they’re facilitating those same buckets by ensuring that they’re learning something, that they’re networking, that they’re being branded, that they’re making financial value, they’re making equity but from an M&A financial standpoint. How do you look at the equity side of it? I know you can look at it from an M&A legal perspective and say hey, this is how you’re going to break this down. you’re going to have common shares. you’re going to have this when you look at it from an M&A financial perspective and you’re shaping that early stage company. you say to them, look, you’re breaking out, there’s three of you right now. there’s going to be 300 of you in the next five years. at least that’s what you’re going to be shooting for. So, here’s how you got to set this cap table up. you’re going to do an ESOP program. you’re going to put in 10 of that at the beginning. when we raise funds, they’re going to do xyz. Is there a little bit you can share on that? on how some of these startups can envision how they should be setting their business up for at least a little bit better for success versus waiting until they’re at series a and then trying to go back and redo all of this. And that’s probably going to cost them more problems than it does if they start today. I mean I think every company is going to be slightly different because they’re going to have a different team in place and different executives, different cap tables. So, different positions that are already filled. So, how much do they need in this case? maybe they had different investors who came in, who act like advisors and therefore do they need it right? because I can tell you that like, look, to do 10 to 15 on an ESOP, and then make sure there’s two to three percent that is there or on top of for advisory rights. But that all depends on who’s your current team and in place at that time. right now, looking at it. I mean there’s a lot of benchmarks already to illustrate what a competitive salary is at that point. right so if you’re looking at the CEO position versus the CTO versus the CFO versus the CEO right, they range from upwards of ten down to one percent right, depending on how much time and what you’re looking for to fill the role, etc. So, definitely, like those are pretty easy to find. You can go online and check angel lists and see all the job descriptions. And like okay, like this is what we’re going to offer. it’d be competitive relatively speaking and you want to be competitive. Otherwise, you’re starting to look cheap and you feel like people are taking advantage of them which is what you’re not trying to do here. as you start getting more granular, I mean once you have a seed round or you have some sort of valuation and you’re priced, you have a value for what those shares are worth. And those are what the shares are worth today. that’s in some cases seen as the net present value right. like what if you were to go and to trade it to somebody else? but many of us who have invested, believe there is upside and that’s why you got the deal. So, that’s why you’re in the game and arguably in many cases, if you do what you’re supposed to do as an employee and everyone does and the whole value should go up, it should reach that next milestone. So, even though that valuation is set today, as an employee you should be thinking, well do I really think that’s a fair valuation or do I think what we’re building really can actually double in value? therefore these shares are worth double in a cent. So, I’m actually getting a great deal on this. And if it doubles, it’d probably continue to go. it’s harder, I get it. like can it be a hundred-million-dollar company? I mean it’s good to be asking that as an employee for sure because you want to see that it does. And what you’re building is to still be around and contributing to it afterwards. But as you get more granular, you can certainly calculate x percentage means x number of potential shares that you’re going to be earning and add that to your salary to show that it’s more beneficial to the other side, also like with your sales team. you can do very aggressive sales compensation for them. And in fact, I’m super like don’t go more aggressive in this case because more often not, you just need to sell right. And that’s what you’re going to raise money on your next metrics, to be able to do so. And that’s what you had really got money, received money, you can change those compensation metrics later on through time. especially when you like new customers versus accounts and then how you manage it. But like the 10 referral fees are low right. you’d be expecting a minimum 30. And I’ve seen other ones be more aggressive, even higher to that for the people who do bring in sales right. I mean that’s if you look at some of the other bigger models like partnership models and distributions, like lightspeed did right. they said hey, you bring us customers. Well, we’ll give you 30 percent of revenues right. So, everyone wants to partner with them right, like find an offer that people have a hard time refusing. And they’re going to see the upside. The hard part though sometimes in the early stage startups is, you just don’t know the pace. So, you’re trying to model it and you’re tweaking it each time and you’re concerned that it’s going to fly off the rail. And you’re going to, all this money and you just got to double check those cash flows. because let’s see if the cash is not in and a bunch of people want you. you got to make sure that’s clean. But the other side is that it might not grow as fast right. as well for the sales, it may sometimes take longer and you want to make sure that they are properly compensated. Otherwise, your sales team’s getting disgruntled and discouraged because they’re trying to sell and get these aggressive packages and targets. But they can’t hit them so it’s just an ongoing iteration especially in the early days to tweak it based on your own company.

Jeffery: I like that. And I really like that comment that you made or the line which I’m going to use which is to find an offer people can’t refuse.

Jan: I think that a lot of the time we’re scared to make that claim or make that push because we’re trying to save everywhere we can and we don’t want to give things away. But at the end of the day, if you’re going to grow your business and find out if your early stage company has a chance of surviving, you really do need to dive into that and say what I need for sales. So, I’m going to be aggressive. I’ll give you 50 of this because maybe it only lasts a year and maybe you close 10 deals. So, yeah you walk away with 200,000. But we’re going to walk away with five new customers that are going to drive our business and prove that we’ve got something good here and maybe there is a way of changing the way I’m wearing this hat and start thinking more aggressively than being too conservative when it comes to sales and building your team.

Jeffery: Yeah, great. And I think overall, everything you shared on how to structure your business and how to structure the next steps with your employees, I think is fantastic. I think there’s always a disconnect and people are always trying to figure out hey, how do I do this? How should I set it up? so I think that that really does offer a lot of value there. And we’ve come a long way in the discussion of how startups and how a Fintech side of things would look at a business. we’re going to shift a little bit of pace here and now I’d like to ask you, to all the companies that you’ve talked to, you said you’ve worked with and helped fund 20 of them, plus all the companies you were with, now you’re probably up to hundreds of companies that you’ve worked with, invested in some capacity, have touched, is there any story that really stood out to you that really showed and defined what it took to be an entrepreneur? and the heartfelt story I guess you thought that she or he was going to fail and they just turned it around and cranked out an amazing company. anything that just pops in your mind. We’d love to learn more on what it takes to be an entrepreneur.

Jan: yeah, I mean there’s a lot of different cases for us. And with our 35 investments to date, maybe I’ll just focus on one company that we’re somewhat known for right now with OWL. it’s doing quite well, when we came in, we were the first checks in and now as they had announced and valued over a quarter billion at this point. And what I’ve seen with them and seen with others that make for great founders is there’s just a resilience and hunger to uncover how to get to that vision, that they’re charting and so OWL is a story. I mean okay, so it’s a serial entrepreneur to begin with already, had a founder market fit in many ways. you came from ad tech but you’re like, okay, well how does that relate to Fintech? Edtech is about profiling people. Profiling software can be fantastic in the Fintech space, especially augmented due diligence or sales or fraud detection. they had multiple products at that and they just kept iterating. they recognized that there’s a lot more money in finance for profiling style technology. I started recognizing that okay, we have three different products we can go after. they’re originally a supercharged sales bot or because you can leverage them to get 70 data points on yourself and I can better target you with very personalized messaging so that I can better service you. I offered you better tailored products, etc. which is good for the customer. But they weren’t quite getting the uptick there. or the key is how they can charge instead of a dollar per search per person for upwards of a hundred dollars which is pretty unheard of that took an iteration, that took multiple products of them launching and saying, okay, well we’re getting some uptick here, there’s some consumer demand but where we’re really starting to get where we’re charging the most when we model it out, when we compare it relative to the products when we look at the sales cycle and how fast we can close them, because we’ve already closed a couple. it really started to come to fruition at the idea of insurance and fraud detection. they were beating insurance fraud teams, the manual teams. they were faster, less errors and cheaper right. all the good stuff right. So, their sale will charge a hundred bucks a search when they uncover that. And then they recognized how quickly they were closing deals. you’re like wow, okay, so they’ve found their flywheel right. They found this growth channel. they found their target area to go after. The flywheel was the ability to find how they line them up and knock them down. All that was like hypothesis testing in my mind, like you have assumptions. they see a path. they see a bigger vision of where they want to go. they know there’s a lot more that can be billed and stuck and attached and associated to it, the decision and the instincts to go from three products down to one didn’t make it easy either. they also had raised a bunch of money on a different belief, had to go back to investors and say we have a different belief. Now you can imagine what it’s like because you’re the investor going, well, I thought we were going this way right. But you need to trust your founders’ instincts. they’re at the front of the line. They know it really well. if you don’t understand, you just sometimes need time. And you work with the founders to unpack it to better communicate it because at the end, then it’ll be easier for more people to join this cause. The best founders will understand that and appreciate that they do need to put words behind what they’re doing and story tell the opportunity to make sure that it is very clear in that. But that ability to just be relentless in knowing okay, we’re stuck here. I need to solve this. There are different assumptions. let’s test this and just relentlessly persisting until they get there now. The hard part though is when you are in a business, that it’s upside down and what you’re building and what you have, it’s like a collection of feature creeps. I’ve been in that story before. I had another very senior tech founder, love, work and great culture. we’re excited to be able to do a business together after several months. We looked at it. When did we just build a collection of features that we’re not? I don’t see the bigger game at this point. it would have required a heavy pivot and then being able to say okay. this isn’t the right play or the timing or whatnot. That is a very difficult decision to make and you need to get there as fast as possible which is incredibly hard as a founder because you’re hanging on to your baby. So, it’s easy to say okay, the winners right. But then how do you identify those? One of the biggest things they say is market timing. it is everything right in it. And I, 100% agree. But in many ways, you might have something that’s close and the ability for the founder to pivot into where the market is and that’s what we saw right there. The sales bot wasn’t working. I bet you in the future people are going to start buying into that. The augmented due diligence gap wasn’t quite there but the pure, the nice area with the flywheels, the wind streams pushing them forward really came on the insurance fraud detection side. And so, the best founders will like to recognize that there are pockets of wind that they can catch to help them fly.

Jeffery: That’s a great story. And I love the fact that the founder really dug in to take the time to understand what the business and what the real model was and then not be afraid to pivot but bring it to the investors and say, hey, look we need to make this change. And what’s great about that story as well as about probably four months ago, I had the opportunity of talking with Sean and we did dive into some of this. So, it was pretty cool then to hear it. But now to hear even more data on how it works is even more exciting because it really shapes the drive behind the founder and the great things that they’re doing. So, that’s fantastic and an awesome story. what we’re going to transition now into our rapid-fire questions. So, pick one or the other. We’ll start on the business side. ready to roll?

Jan: sure.

Jeffery: Let’s bring it.

Jan: I guess. Hopefully this coffee kicked in at this point.

Jeffery: Let’s go.

Jan: All right.

Jeffery: Perfect. All right. founder or co-founder?

Jan: sorry, I’m trying like in, if you would invest, would you invest in a founder or a co-founder? We prefer co-founders. We prefer multiple disciplinary teams but we, unlike others, won’t say no to a founder.

Jeffery: okay, unicorn or four-year 10x exit?

Jan: we’re swinging for the fences. We are really certainly going for unicorns. But okay getting a couple of these base hits along the way.

Jeffery: Okay, tech or cpg?

Jan: Everything is tech right now for us. we’re very b2b right now, hence why we were looking at it that way. But yeah, I’ll just rapid-fire tech.

Jeffery: okay. Brand or tech?

Jan: brand or tech? I love tech. But brands and good distribution channels and whatnot can sell better. So, you can have a crappy product in front of people and still be able to sell it. But I do believe that your brand will falter through time if you don’t have the right tech. So, they go hand in hand. Maybe I’ll say your tech needs to feed your brand in some ways too. So, the story of your tech needs to come out in your brand.

Jeffery: perfect. ai or blockchain?

Jan: I love blockchain right now because it’s less well understood. I think there is still a lot of blue ocean to go after in it. although we used to halt exchanges or hold accelerator ai. I think every company should be doing ai. it is a fancy word for just like augmented analytics for the most part right now, so bullish on this new web 3. 3.0.

Jeffery: Okay, first time founder or second or third time founder?

Jan: I mean obviously prefer a second- or third-time founder. they have enough stripes on their belt or battle loons to show for it when feasible that’s for sure.

Jeffery: angel or VC?

Jan: We play with both of them. We like them in different ways. it’s just about what is best for the company. If it’s good, I prefer to work with the VCs and institutions that we do align with. Although like anything, you can have ones that are aggressive and want to push you out for their own particular rounds. So, each has their pros and cons shall we say. But if you work with a good institutional VC, they can play a big strategic role in supporting. we’re all about co-investing and they can usually have more depth to be able to support the entrepreneurs.

Jeffery: Would you prefer taking board seats or observer seats?

Jan: We prefer for the moment right now, considering the amount of portfolio companies, is observer seats. But even then, we’re not as big as taking the seats we feel we have through our own mechanisms, our own meetings, our own time, that we get enough face time with them, that we know enough about the company itself. We can influence the direction. We have a good enough relationship. We don’t even believe in having too much essentially, like pushing the control that we’ve been fined with no seats, even safe for a convertible note, the people are generally moving towards the safe which is a convertible note. in some ways, when you think about it, but generally, that’s the clean we watch what usually comes out of the US and the valley and really simplified safes or kisses right is just keep it as clean as possible. seems the way to go but depends right. We just want what’s best for entrepreneurs. if you were to actually look in Asia right now, convertible notes are still all the rage. And if that’s easier for them to close around, we’ll do it. But preference right now, to keep it as easy as possible.

Jeffery: Okay, lead or follow?

Jan: we’re generally a follower right now per se. Although we get thrust into this sort of lead role occasionally where we prop up others, we give our data to help support the pricing and even the documentation for certain rounds. But more often, we are technically following equity or interest payments, equity.

Jeffery: favorite part of investing?

Jan: founders.

Jeffery: number of companies invested per year?

Jan: eight.

Jeffery: preferred terms?

Jan: we’re generally on what we call aces that look like a safe essentially right now which then gets us press shares on the next round.

Jeffery: okay. Well, verticals of focus?

Jan: Well, Fintech is itself being a generalist as the joke goes for those that are in the space. So, within that, there’s a whole gambit right, like we’d be bucketding into wealth tech and cryptocurrency and payments and like insurance and cyber security. So, anything within Fintech.

Jeffery: And what are two things that stand out that you need to see to make an investment into a startup?

Jan: I mean the big thing they have to hit is our four quadrant which is their four axis blueprint. So, the founder market financing product. And then underneath that obviously, we go deeper. But another big caveat. So, the second one I would say is the fit with our advisor ecosystem right. the ability for them to always see through our 500 advisors, whether or not that can be value add to them and there’s a need so that we can accelerate any of those exchanges

Jeffery: perfect. Okay, we’re going to jump into the rapid fire of personal questions.

Jan: cool.

Jeffery: All right. book or movie?

Jan: depends on how I’m feeling. Is that a fair answer? if over the holidays if I have time to step back, book. If I am really exhausted after another 100 hour slog, let’s watch a really brain dead movie.

Jeffery: All right. Superman or batman?

Jan: You’re going to go with batman. I just love the human side of him that seems to always persevere I suppose.

Jeffery: I love it. pizza pop or ice cream bar?

Jan: ice cream every day, all day.

Jeffery: five minutes with Bezos or Oprah?

Jan: I wonder. I feel like Oprah might actually better connect with her. I don’t know if Bezos would be fully out of tension at that point. He’s got too much stuff going on. I feel like Oprah has been from how she conveys in her shows.

Jeffery: I like it. Arsenal or Manchester United?

Jan: not a football fan. So, I’m trying to think what would my girlfriend be more annoyed with if I picked which company. let’s go. I think Manchester United.

Jeffery: good answer. I like that. All right. Different. Bike or rollerblades?

Jan: rollerblade. I like to make fun of me, but I’m pretty hardcore about it. I get pretty suited up and I go on the canal and I get off the roll blades a lot. it’s a good time. Oh, the canal is awesome.

Jeffery: That’s cool. big mac or chicken mcnuggets?

Jan: I mean I’m a big extra fan to be honest. I’m going to throw a curveball in there but add the big mac sauce so I guess that puts me closer to the big mac category.

Jeffery: All right. trophy or money?

Jan: trophy or money. money can buy you more stuff to do more good with it. So, right now I’d be saying take the money.

Jeffery: beer or wine?

Jan: I’m a big IPA fan but I guess it depends on the time of day. So, what am I having and what am I eating? I guess the question over a meal gets me some red wine all right.

Jeffery: alarm clock or mobile phone?

Jan: oh, my mobile phone all the way for better or worse. I don’t know if that’s a good thing but nothing wakes you up faster than reading a bunch of emails.

Jeffery: hotel or hostel?

Jan: hostel. I’ve grown past this point. I’m going to need my rest. I’m going to a hotel. finger rich. Sorry.

Jeffery: king or rich?

Jan: king or rich? king or queen? king or rich? or rich? I think I’d prefer just to be rich. The fame that comes with being the king and the responsibility seems daunting versus rich where you can control things silently, I suppose in a good way.

Jeffery: I like it. concert or amusement park?

Jan: I guess it depends on the day right now. I’m craving a good concert to be honest. I miss the days when Oceanago was open and hopefully we’re going to get that back soon.

Jeffery: fortune cookie or birthday cake?

Jan: birthday cake, especially ice cream cake. Going back to one of your earlier questions, bam agreed.

Jeffery: ted talk or book reading?

Jan: more often if I have the energy capacity, I want to read a good book.

Jeffery: Then all right we’re getting close. favorite sports team?

Jan: I hang on to it going back to my roots for better for worse and where it’s worse this year, Ottawa senators.

Jeffery: nice. favorite movie and what character would you play in the movie?

Jan: favorite movie? The only one that comes to mind as geeky as it sounds right now is I guess the Matrix because it’s coming up right now on December 22nd. So, I guess if that’s the movie, then you obviously want to be Keanu in that.

Jeffery: I like it. favorite book?

Jan: which I feel like sometimes we’re trying to ask me what my top security questions are right now. But I really liked “I still do remember sapiens.” when I first read that one, I thought that was one to just give me a very different perspective to challenge my purpose I suppose and say hey what’s it all for? but came out stronger for it. That’s a great book.

Jeffery: great book all right. the first brand that pops into your mind?

Jan: Nike. But mostly because of Jordan. So, I feel like maybe, is it Jordan?

Jeffery: true. the most famous person that pops into your mind?

Jan: Elon Musk, I guess. I don’t know, maybe because I just saw some tweets that he just did right.

Jeffery: So awesome. All right. last question. What is your superpower?

Jan: my super power I think I am relatively patient. although when you get tired, your superpower needs to recharge at times. But I think that’s a pretty key to have. And because there’s always three sides to a story and being able to have the patience to be able to properly listen through all of it is pretty key.

Jeffery: agreed. No. That’s a huge skill to have especially when you’re working with a lot of different startups and investing. I think patience is probably the best thing you can have because nothing comes right away and things take a lot of time. So, I think that’s a great quality. well Jan I want to thank you very much for all your time today. I appreciate all the things that you’ve shared. I’ve taken lots of notes as I always have to show it and can’t really see it. But I’m a note taker. But this was good. I appreciate the whole walk through, love what you guys are doing, huge focus on all of Fintech generalized or not. pretty amazing. Thank you again for all your insights and the way we like to end things is like giving you the last word. So, anything that you want to share to the investor community or to the startup community I turn it over to you. But thanks again for all your time. Awesome.

Jan: well appreciate the last word. I’d say that two things, one we’re always looking for world-class advisors to join this army here. They’ve been fantastic, incredibly value-added and they see a lot of great value with their ability to connect with other advisors, make some deals with our startups, learn a whole bunch in a pretty fun way and check out our last show that we pulled off. And with that, we have an advisor only fundraiser. it’s the only thing I’ve ever seen. And the way we built it is incredibly unique, so happy to talk through those advisors who are interested and participating which I truly believe is the future of VC investing. And then to the great founders out there always willing to have conversations right. see if we can support. see if we just have where we think you fit position relative specifically to us or to others and see if there’s a time that we can potentially invest, collaborate as we go into next year. And we look for our next eight batch of companies.

Jeffery: I love Jan. Thank you very much again. That was brilliant. Thank you. Awesome. Thanks so much for the time. super appreciated.

Jan: You bet.

Jeffery: Okay. That was a great discussion with Jan and we really liked some of the things that he brought up, especially on the four pieces that they look for: founder, market finance and product. It is a great way to put together what that startup looks like. you talk about ESOP programs and how you should be setting up your business, when you should be getting into a CFO or when you should be bringing that type of person in that role on like anything you do learn, what’s the financial value, what’s the branding, where are you going to meet and what’s the work environment like. So, a lot of great things unfold. But again, Jan thank you very much for deep diving on that. And thank you everybody for joining us today. if you enjoyed the conversation, please subscribe to our YouTube channel or follow us on Spotify apple podcast on our Stitcher. You can also check us out at supportersfund.com or for startup events at opn.ninja have a great week.